WorkApps Package your entire business program or project into a WorkApp in minutes.Digital asset management Manage and distribute assets, and see how they perform.Resource management Find the best project team and forecast resourcing needs.Intelligent workflows Automate business processes across systems.Governance & administration Configure and manage global controls and settings.Streamlined business apps Build easy-to-navigate business apps in minutes.Integrations Work smarter and more efficiently by sharing information across platforms.Secure request management Streamline requests, process ticketing, and more.

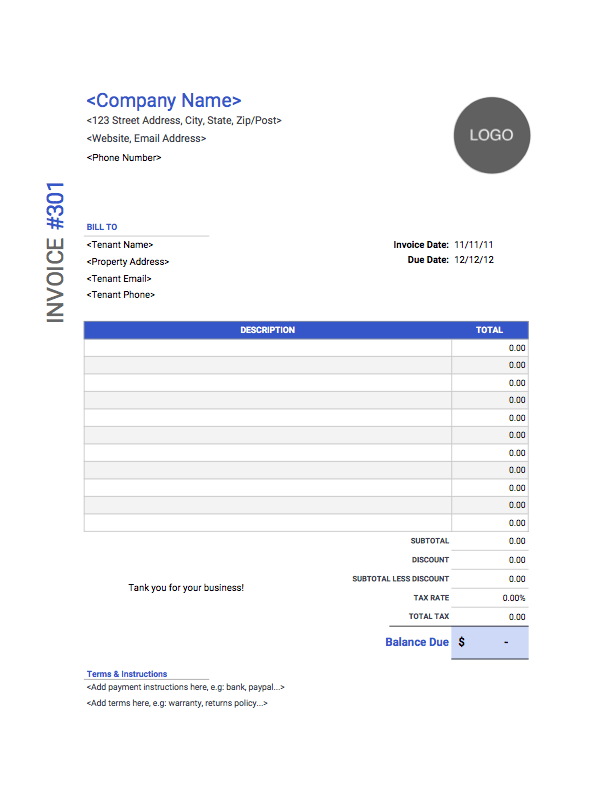

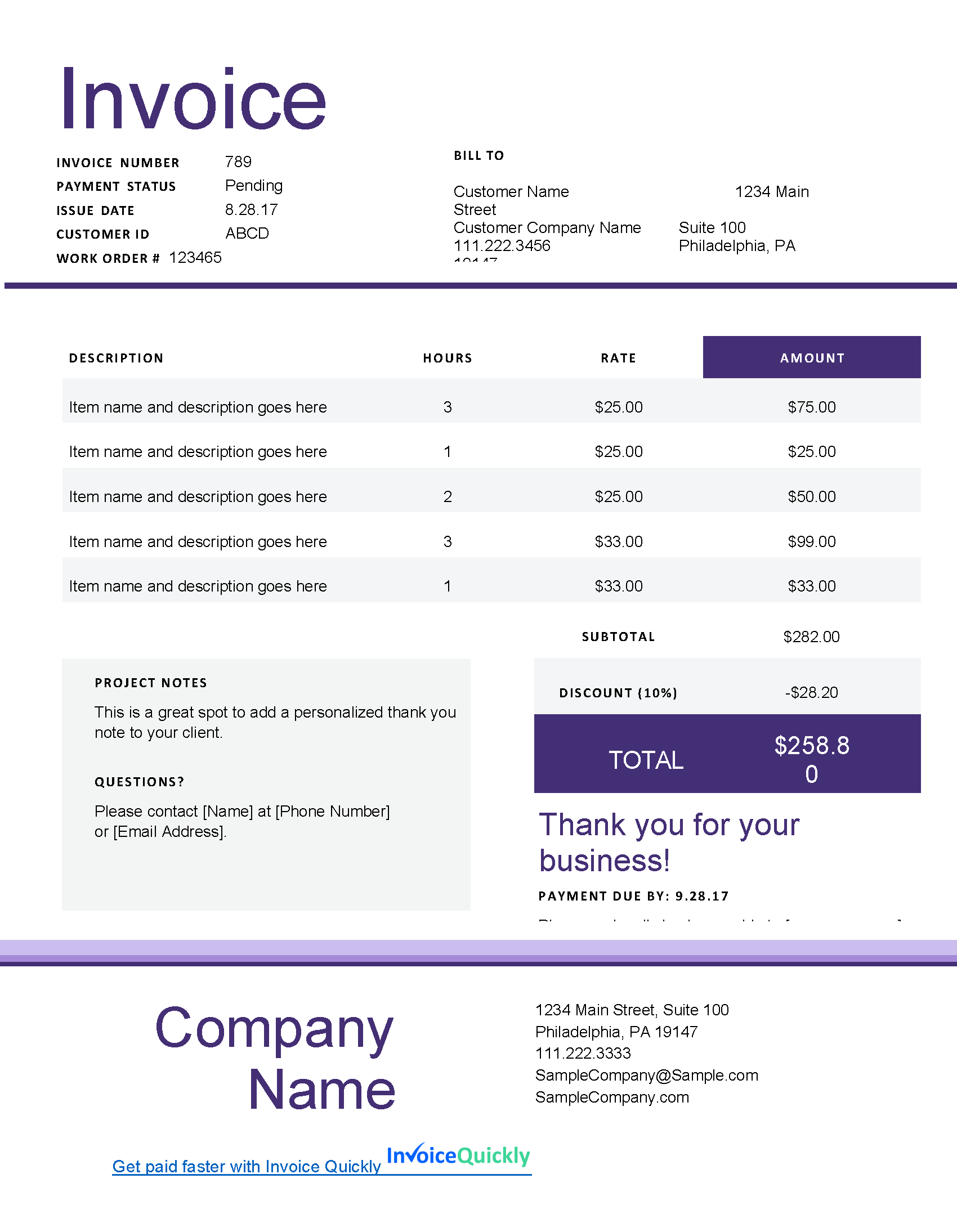

Portfolio management at scale Deliver project consistency and visibility at scale.Content management Organize, manage, and review content production.Workflow automation Quickly automate repetitive tasks and processes.Team collaboration Connect everyone on one collaborative platform.Smartsheet platform Learn how the Smartsheet platform for dynamic work offers a robust set of capabilities to empower everyone to manage projects, automate workflows, and rapidly build solutions at scale.Notes: Include any additional info your customer should know, including terms of service and payment terms (for example, payments are due 30 days after the invoice has been issued).Total: Outline the total amount due from the customer, after tax.This is legally required to provide on invoices, and your rate may differ depending on where you run your business. Tax: Indicate the tax rate applied to the subtotal.Subtotal: Add up the subtotal of your goods or services, before tax has been applied.For each line item, include a brief description, quantity, individual unit price, and total price. Line Item: Add individual line items for each unique good or service you provided.Dates: Include the date when your invoice has been issued and the date when payment is due.For example, if you're sending your very first customer their first invoice, the invoice number could be 001-001.

You can format this based on sequence and customer.

0 kommentar(er)

0 kommentar(er)